|

|

BHW Resident Surgeon

Posts: 25351

Location: Bastrop, Texas | Vickie - 2015-12-24 4:43 AM

Bear - 2015-12-22 2:28 PM Vickie, do you own any retirement plan? IRA? 401K? Answer that, please. Yes I have retirement, in a savings account and in a Roth IRA. No I do not trust Wall Street at all, that is my point. I think you misunderstood when I talked about corruption, I definately did not mean doctors, I meant the inurance companies, the pharmacy companies, the private hospital groups and the private nursing home groups. Doctors can hardly make a profit now a days due to decreased payments from these groups. These greedy people are buying their way into every aspect of our country and doing it by buying politicians. We have to get our politics under control and then we can start cleaning up the corruption. And I don't care who is in the White House, the problem doesn't even start there with the "house temp" We have a new president every 4 or 8 years but nothing changes, does it? Lobbying must be stopped. No one should go into politics to become rich, but they do, don't they?

OK, Vickie. You have invested in a Roth IRA. That is smart, and I'd be willing to bet you would do it again. That means you cannot be taxed on a single penny your Roth earns...ever. That Roth IRA has probably performed at or around 5-8% annual rate of return since its inception over 25 years ago. That money is invested in securities...stocks and bonds. In other words, you put your own money in "Wall Street". If it's good enough for your Roth, I say why not have your social security go into a similar investment vehicle? This idea that social security is some sort of sacred cow is pure hogwash promoted by politicians who love to use it as a political tool for the feeble minded. Look up the long term performance figures of Vanguard, for example. There are peaks and valleys in yields, but over 40 years time, you would be infinitely more wealthy if your money was invested in a moderate-conservative fund, as opposed to SS where most only get a fraction of their investment, by comparison. | |

| | |

BHW Resident Surgeon

Posts: 25351

Location: Bastrop, Texas | SmokinBandits - 2015-12-23 10:02 PM

Vickie - 2015-12-22 2:25 PM Bear - 2015-12-22 2:13 PM It's simply a matter of comparing the value of two different investment strategies. Status quo: 1.) A "promise" to provide basic healthcare needs, IF you live long enough, which often necessitates a supplimental policy to cover anything that the .gov refuses to cover. 2.) A "promise" to grant you a minimum subsistence income once you retire. One that usually can't meet the bare minimum on which you can live......again, that is IF you live long enough. 3.) Does nothing for the economy.....no revenues, no investment, no jobs. 4.) If you die and have no living dependents, the IOU gets torn up. In other words, the system incentivizes early death. Goes hand-in-hand with Medicare, interestingly. Privatized System: 1.) Allows you to select from a wide range of insurance options that would be available from a competitive free market. Of that several hundred thousand dollar nest egg reserved for healthcare needs, you could choose a catastrophic plan that would easily be affordable for your lifetime, with more than enough to cover the deductibles for the rest of your life. 2.) In the case of retirement income, you can easily live at or above the level you lived on while working, without putting much of a dent in that nest egg. 3.) Creates a "stimulus" to the economy through the infusion of hundreds of billions every year....maybe even more than $1 Trillion. This stimulus would be via non borrowed money....investments through the private sector. This generates tax jobs, incomes, and massive tax revenues, which could both fund a system designed to care for the poor, as well as lower our national debt. Gee...imagine that. 4.) If you die, it goes wherever you want......charity, family, whatever. That's because you own it. For a peek at how this would work, take a look at how it worked for Galveston county. They were able to opt out of social security, in lieu of their own privatized system. Your "stimulis" is hard working people's money being turned over to investors who will theoretically make you money for your retirement. Do you really trust Wall Street with your future ? These are the same crooks who tanked our economy with their money grubbing schemes. Don't fall for it. We will keep our money invested in our land, our livestock and our future. The "investors" will get no more of mine to turn into their obsene profits.

If you owned your SS and it was invested in a typical low to moderate risk mutual fund, over the life of that investment, you would be so much better off, it isn't even funny. You can't look at 5 or even 10 year numbers. There will always be peaks and valleys. You have to look at the life of the fund.....at least 40 years. Back in the 90's, there were years where if you didn't make 15% rate of return, something was wrong. In recent years, you would be lucky if you earned 3-4%. That's normal ebb and flow. You only lose money if you cash it in. | |

| | |

BHW Resident Surgeon

Posts: 25351

Location: Bastrop, Texas | SmokinBandits - 2015-12-23 10:02 PM

Vickie - 2015-12-22 2:25 PM Bear - 2015-12-22 2:13 PM It's simply a matter of comparing the value of two different investment strategies. Status quo: 1.) A "promise" to provide basic healthcare needs, IF you live long enough, which often necessitates a supplimental policy to cover anything that the .gov refuses to cover. 2.) A "promise" to grant you a minimum subsistence income once you retire. One that usually can't meet the bare minimum on which you can live......again, that is IF you live long enough. 3.) Does nothing for the economy.....no revenues, no investment, no jobs. 4.) If you die and have no living dependents, the IOU gets torn up. In other words, the system incentivizes early death. Goes hand-in-hand with Medicare, interestingly. Privatized System: 1.) Allows you to select from a wide range of insurance options that would be available from a competitive free market. Of that several hundred thousand dollar nest egg reserved for healthcare needs, you could choose a catastrophic plan that would easily be affordable for your lifetime, with more than enough to cover the deductibles for the rest of your life. 2.) In the case of retirement income, you can easily live at or above the level you lived on while working, without putting much of a dent in that nest egg. 3.) Creates a "stimulus" to the economy through the infusion of hundreds of billions every year....maybe even more than $1 Trillion. This stimulus would be via non borrowed money....investments through the private sector. This generates tax jobs, incomes, and massive tax revenues, which could both fund a system designed to care for the poor, as well as lower our national debt. Gee...imagine that. 4.) If you die, it goes wherever you want......charity, family, whatever. That's because you own it. For a peek at how this would work, take a look at how it worked for Galveston county. They were able to opt out of social security, in lieu of their own privatized system. Your "stimulis" is hard working people's money being turned over to investors who will theoretically make you money for your retirement. Do you really trust Wall Street with your future ? These are the same crooks who tanked our economy with their money grubbing schemes. Don't fall for it. We will keep our money invested in our land, our livestock and our future. The "investors" will get no more of mine to turn into their obsene profits.

If you owned your SS and it was invested in a typical low to moderate risk mutual fund, over the life of that investment, you would be so much better off, it isn't even funny. You can't look at 5 or even 10 year numbers. There will always be peaks and valleys. You have to look at the life of the fund.....at least 40 years. Back in the 90's, there were years where if you didn't make 15% rate of return, something was wrong. In recent years, you would be lucky if you earned 3-4%. That's normal ebb and flow. You only lose money if you cash it in. | |

| | |

To the Left

Posts: 1865

Location: Florida | Bear, now we are getting into the difference between defined contributions and defined benefits. Unfortunately again we get into politics. IBM retirees had defined benefits, the best thing for employees. Sadly when the company started to fall on hard times the first place they looked for money was their retirement trust fund. They convinced the courts that they shouldn't have to honor the union contracts from so many years ago and pay their retirees when they were having problems making a profit. In a horific decision during the Reagan years, the courts decided that companies should not have to honor retirement commitments if it interfered with the bottom line profit.

It is still happening today. When a company says we are going with a 407k, that is defined contribution. What you get from that is decided by Wall Street and the stock market. It is not retirememt at all, it is a forced contribution to the big banks for their profit.

Social Security is defined benefits plan. If you privatise it then it becomes defined contribution. Only a fool would choose defined contributions with this financial climate.

Edited by Vickie 2015-12-24 1:04 PM

| |

| | |

Semper Fi

Location: North Texas | Vickie - 2015-12-24 12:59 PM

Bear, now we are getting into the difference between defined contributions and defined benefits. Unfortunately again we get into politics. IBM retirees had defined benefits, the best thing for employees. Sadly when the company started to fall on hard times the first place they looked for money was their retirement trust fund. They convinced the courts that they shouldn't have to honor the union contracts from so many years ago and pay their retirees when they were having problems making a profit. In a horific decision during the Reagan years, the courts decided that companies should not have to honor retirement commitments if it interfered with the bottom line profit.

It is still happening today. When a company says we are going with a 407k, that is defined contribution. What you get from that is decided by Wall Street and the stock market. It is not retirememt at all, it is a forced contribution to the big banks for their profit.

Social Security is defined benefits plan. If you privatise it then it becomes defined contribution. Only a fool would choose defined contributions with this financial climate.

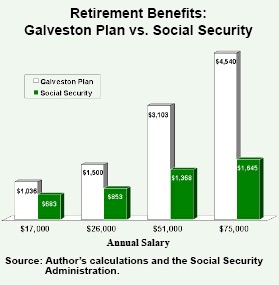

Galveston Texas, the City of, opted out of Social Security in 1982 and historically and currently is doing better by its retirees than Social Security. In essence Galveston privatized S.S., there is historical and current precedents to argue/prove Privation of S.S. has been and is successful.............................

My point is this, anything and anytime the Federal Government has interfered in Private American's PERSONAL Business, the has been negative to the point of being a nightmare! The current event to prove this is ObamaCare! | |

| | |

BHW Resident Surgeon

Posts: 25351

Location: Bastrop, Texas | Vickie - 2015-12-24 12:59 PM

Bear, now we are getting into the difference between defined contributions and defined benefits. Unfortunately again we get into politics. IBM retirees had defined benefits, the best thing for employees. Sadly when the company started to fall on hard times the first place they looked for money was their retirement trust fund. They convinced the courts that they shouldn't have to honor the union contracts from so many years ago and pay their retirees when they were having problems making a profit. In a horific decision during the Reagan years, the courts decided that companies should not have to honor retirement commitments if it interfered with the bottom line profit.

It is still happening today. When a company says we are going with a 407k, that is defined contribution. What you get from that is decided by Wall Street and the stock market. It is not retirememt at all, it is a forced contribution to the big banks for their profit.

Social Security is defined benefits plan. If you privatise it then it becomes defined contribution. Only a fool would choose defined contributions with this financial climate.

What I'm talking about would not be a trust fund. It would be identical to SS in terms of contribution $ amount. The employers portion of the contribution would go toward the individual's designated IRA. The same rules would apply.......except I would say you ought to be able to withdraw at age 59 1/2, or early withdrawl, in the event of disability. This would not be a "benefit" per se'. Scare tactics suggesting that evil corporations will raid the account would not work, because they wouldn't have access to it. When you die, it becomes part of your estate. I think this would also be a huge incentive for "work over welfare" because people would quickly realize it's a pretty sweet deal and they would want to get in the game. The impact on the economy and jobs and revenues to the fed would be huge.....in essence, about the same amount of money as that awful "stimulus plan of 2009", except that stimulus plan was all borrowed money.....this would be real, year, after year. I just don't understand the logic of saying it would be too risky, when the same individuals are putting their own money in "Wall Street" whether it's a Roth or any other retirement vehicle. A lot of people have contributed to SS for 40-50 years and what do they get? Many get a meager "entitlement" check for $1000-1500 a month, and the government and politicians make us feel that it's some sort of magnanimous gesture. I say, entitlement my ass.....that's OUR money. Even people who earn below average wages over their life span could get a comfortable income for the rest of their lives without having to be beholding to political fear tactics. As Foundation Horse suggested, don't take my word for it. Look at Galveston Texas and their experience. | |

| | |

BHW Resident Surgeon

Posts: 25351

Location: Bastrop, Texas | http://www.ncpa.org/pub/ba514

(image.jpg) (image.jpg)

Attachments

----------------

image.jpg (20KB - 149 downloads) image.jpg (20KB - 149 downloads)

| |

| |

| |